About Us

In 2010 a group of professionals with a solid background in international business consulting decided to share in the experience accumulated over the years to create a new project: supporting clients operating internationally in a proactive way.

Goldberg Securitization is thus established with the opening of offices in Luxembourg.

At present, the Goldberg Securitization, consisting of more than 10 staff members and twenty partners, is operating in Luxembourg, United Kingdom, Switzerland, Ireland and Far East.

The core-activity of Goldberg Securitization is securitization of equity asset. Our clients comprise small and medium-sized enterprises with inclination, potential and flexibility for a successful international expansion into overseas markets.

The Philosophy

The Strategy

Expertise

What We Do

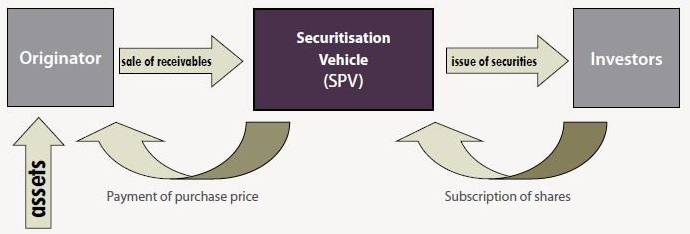

Securitisation can be defined as any financing process by which an entity (originator) transfers one or more assets or risks to a dedicated vehicle (Securitisation vehicle) in exchange for cash, as the securitisation vehicle is financed by the issuance of securities backed by the assets (collateral) transferred and the income generated by those assets.

Securitisation involves both a process of integration and differentiation.

- Integration: homogeneous, cash flow producing but illiquid assets are pooled together into an investment vehicle (i.e. securitisation).

- Differentiation: the cash flows generated by the pool of assets are redirected to support payments to instruments issued by the securitisation vehicle to the capital markets.

The instruments issued by the securitisation vehicle do not all need to show the same characteristics. By allocating to each instrument (or tranche) a different priority of payment of interest and principle as well as a different rate of return, each instrument (or tranche) will satisfy the riskreturnmaturity characteristics of a different investor.

Even after the recent financial crisis, skilled securitisation is here to stay as only securitisation allows to satisfy the needs of a growing class of sophisticated investors.

From a Luxembourg point of view, the Law on securitisation dated March 22nd 2004 created a specific legal and tax framework for securitisation vehicles. However, even before the law was enacted, Luxembourg companies were engaged in securitisation activities based notably on the law on transfer of claims and assets to a financial institution or the law on mortgage banks.

The new Luxembourg law has been designed while relying on local and international expertise in securitisation. The main aspects of the law can be summarized as follows:

- flexibility;

- investor protection;

- tax neutrality.

Consequently, this new law provides a response to the market’s needs and has begun to feature prominently in the European securitisation market.

Goldberg Securitization provides a range of services for clients, including administration, tax advice and security issuance. To request a brochure and the list of our ABS bonds currently subscribable, click on the button “more information”.

Please find more information about Securitisation services on BCL website.

Offices

GOLDBERG SECURITIZATION S.A.

34 Avenue Marie-Thérèse L-2132 Luxembourg

Share Capital € 70.000,00

Inscrite au Registre de Commerce de Luxembourg, Section B158522

TIN n° 2011 22 01042

Banque Centrale du Luxembourg Enregistrement n° T158522

Contacts

[email protected]

+352 26 201 239

+44 2070 7874 25

+44 2070 1019 429 (fax)